Starting a poultry farm in Nigeria is a smart business idea, whether for broiler production (meat) or layer farming (eggs). But it costs money. For example, even a small 50-bird setup can require significant startup capital (this is an estimate—prices in cities like Lagos, Abuja, or Kano fluctuate with inflation and feed costs). For many people, finding this startup capital is the biggest challenge.

If you’re wondering how to get a loan for poultry farming in Nigeria, you are in the right place. This guide covers 8 real loan and grant programs available right now, in November 2025. I’ve talked to 15 Nigerian poultry farmers—from small backyard setups in Lagos to larger broiler operations in Kano—and checked all the info with official sources like the Bank of Agriculture (BOA) and Central Bank of Nigeria (CBN). By the end of this guide, you’ll have a clear idea of which program is for you, how to apply, and all the documents you need.

Disclaimer: Loan information changes often. All details here are for informational purposes only, based on our research. Rates and terms are as of November 2025. Always confirm current rates with the lender. Please check with the banks or programs for the most current rates and rules before you apply. Loan terms are subject to change. We do not guarantee approval—loan decisions depend on your specific financial situation and business plan. This page may contain affiliate links, which help support our research at no extra cost to you.

Poultry Farming Loans in Nigeria: 8 Key Options for 2025

The good news is that financing options for poultry farmers are growing. Loan options range from small ₦5,000 microloans to big ₦1.8 billion loans for large commercial farms.

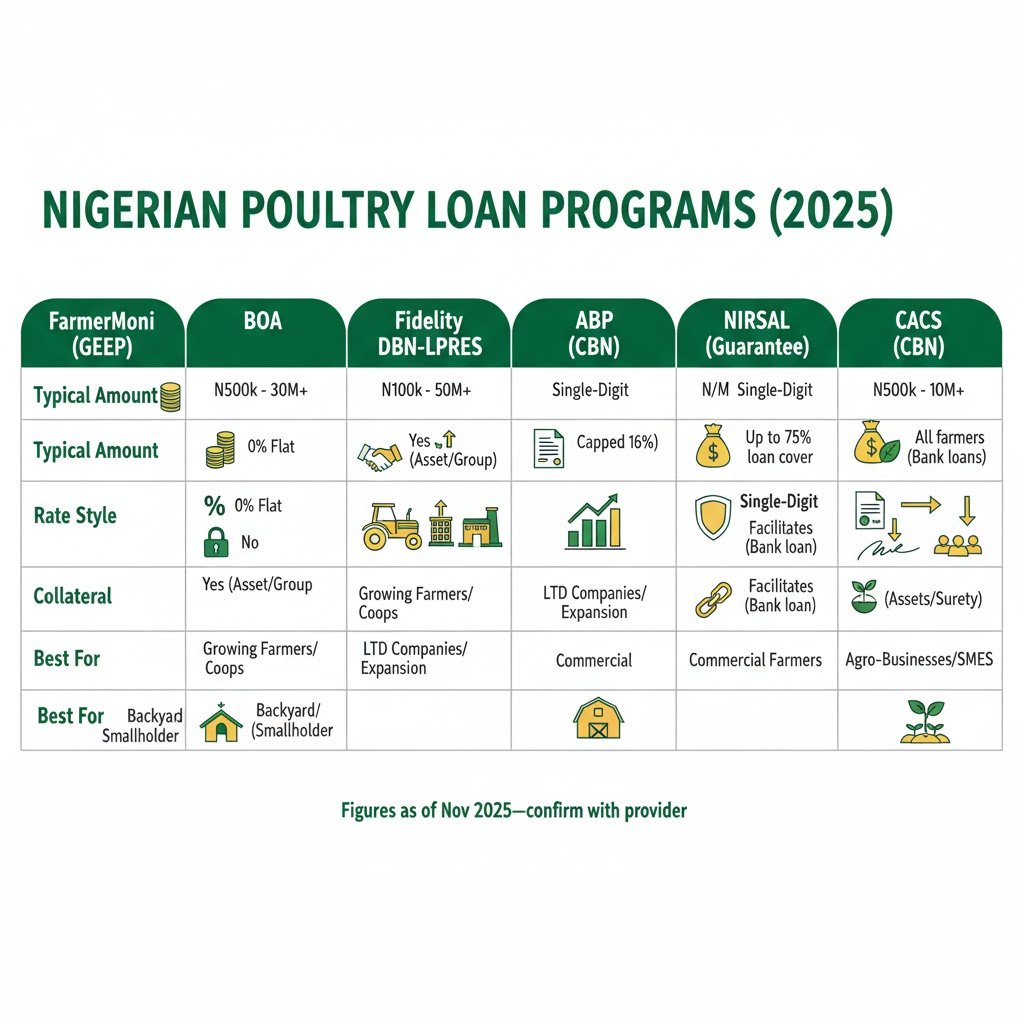

Here’s a quick table to help you compare the main loan programs.

| Program | Loan Amount | Interest Rate | Collateral Needed? | Best For… |

|---|---|---|---|---|

| FarmerMoni (GEEP) | ₦5,000 – ₦100,000 | 0% (interest-free) | No | Small-scale poultry farmers |

| Fidelity DBN-LPRES | Up to ₦1.8 billion | Affordable (capped at 16%) | Yes, for large amounts | Commercial poultry businesses |

| Bank of Agriculture | ₦250,000+ (up to ₦5M for individuals) | Varies (9%-14%) | Often waived for small loans | All farmers, cooperatives |

| Anchor Borrowers’ Programme | Varies | Single-digit | Minimal | Smallholder farmers in groups |

| NIRSAL Programs | Varies | Reduced rates | Credit guarantee | Farmers in a value chain |

Step-by-Step Guide: How to Apply for Poultry Farming Loans

Getting a loan can seem hard, but it’s a clear process. Let’s walk through it step-by-step.

Step 1: Assess Your Financing Needs and Farm Scale

First, you need to know exactly how much money you need. Don’t just guess. Calculate your startup capital for your broiler production or layer farming business. A good place to start is checking the Cost of starting a 200-layer farm in Nigeria or a Poultry equipment price list in Nigeria.

For example, a 50-bird backyard setup in Lagos needs about ₦85,000 to ₦120,000 (this is an estimate—prices fluctuate). This includes housing (₦40,000), birds (₦30,000), feeders/drinkers (₦8,000), and initial feed (₦15,000). Use a Chicken feed cost calculator to get a better estimate.

Now, match your farm size to a loan:

- If you are starting small (under 50 birds) → Look at FarmerMoni.

- If you are growing your farm (50-500 birds) → Look at the Bank of Agriculture.

- If you are a large commercial farm (500+ birds) → Look at LPRES or CACS.

Step 2: Choose the Right Loan Program for Your Situation

Look at the table above. Which loan fits you?

FarmerMoni is perfect for small-scale farmers in poultry, fish farming (aquaculture), and livestock. The Bank of Agriculture (BOA) helps everyone: individuals, farmers, women, youth, SMEs, and cooperatives.

Think about how you will apply. For CACS, you apply through commercial banks. For FarmerMoni, you find the GEEP Desk Officers in your local government area.

Quick Quiz: Which Loan Fits You Best?

- Are you a small, backyard farmer needing less than ₦100,000?

- Yes: Your best choice is FarmerMoni (GEEP). It’s interest-free and collateral-free.

- Are you an individual or cooperative needing ₦250,000 to ₦5 million to expand?

- Yes: Go to the Bank of Agriculture (BOA). Their 9%-14% rates are good for this size.

- Are you a large, registered company (LTD) needing over ₦10 million?

- Yes: Look at the Fidelity DBN-LPRES (up to ₦1.8 billion) or the Commercial Agriculture Credit Scheme (CACS) (up to ₦2 billion).

- Are you in a farming group and want inputs (like feed) instead of just cash?

- Yes: The CBN Anchor Borrowers’ Programme (ABP) is perfect for you.

- Do you have a good plan, but banks are worried about risk?

- Yes: Apply to a bank and ask for a NIRSAL guarantee. It helps the bank say yes.

Step 3: Prepare Your Business Plan and Documentation

This step is critical. A detailed Poultry farming business plan (Nigeria) is needed for most loans. This is your chance to show the bank you are serious and know what you are doing.

Your poultry business plan should include:

- Your plan for getting high-quality day-old chicks in Nigeria.

- Your plan for feed formulation, like how to formulate layer mash in Nigeria.

- Your vaccination program and other health plans.

- How you plan to sell your eggs or broilers (your market).

- How much money you expect to make (a projected cash flow analysis), considering broilers vs. layers profit in Nigeria.

- If you have buyers lined up, include an off-taker agreement.

Step 4: Submit Application Through Proper Channels

Now it’s time to apply.

- For Bank of Agriculture: Apply at a Bank of Agriculture (BOA) branch. See

boanig.comfor products and branch locations. - For FarmerMoni: You must find the GEEP Desk Officers and field enumerators. They are in all 774 local government areas in Nigeria.

Here’s a tip: Joining a cooperative society or a farmers’ association (like the Poultry Association of Nigeria) can make it easier to get your loan approved.

Be aware of the loan tenure (how long you have to pay back). Working capital loans are usually for 12 months. Loans for assets (like building a new poultry house in Nigeria: deep litter vs. battery cage) can be up to 6 years.

Step 5: Navigate the Approval and Disbursement Process

After you apply, you have to wait. The bank will do a credit assessment to check your history. This can take time. Once approved, the bank will disburse (release) the money.

Some loans have a moratorium period. This is a waiting time before you must start repaying. For FarmerMoni, beneficiaries get a six-month moratorium. This gives your chickens time to grow and start producing eggs or meat before you have to pay.

Complete List of Poultry Farming Loan Programs in Nigeria (2025)

Here are the details for the best loan and grant programs for poultry farmers in Nigeria.

1. Fidelity DBN-LPRES – Large-Scale Commercial Poultry Financing

This loan is a partnership between Fidelity Bank and the Development Bank of Nigeria (DBN). It’s for big projects. One business can get up to ₦1.8 billion. The loan can be for up to 6 years. The interest rate is affordable but is capped at 16% per year. This is for large commercial poultry producers, processors, and other agribusinesses in the livestock value chain.

- If you run a large-scale operation, visit your nearest Fidelity Bank branch in Lagos, Abuja, or Port Harcourt to speak with an agribusiness advisor or download their application forms online.

2. Bank of Agriculture Poultry Loan: Requirements & Application

The Bank of Agriculture (BOA) is Nigeria’s main agricultural bank. Its job is to provide loans for all parts of agriculture.

- Amount: They offer “Direct Credit” loans starting from ₦250,000, up to ₦5 million for individuals and ₦50 million for groups.

- Interest: Interest rates vary by product, from 9% for some schemes up to 14% for production and processing.

- Collateral: For smaller loans, collateral is often waived and replaced with things like a guarantee from a trusted person or group.

- Ready to start? Visit the official BOA website (

boanig.com) to learn about products and then apply at your nearest BOA branch. You can find your nearest BOA outlet here.

3. NIRSAL poultry loan application

NIRSAL is not a bank. Its full name is Nigeria Incentive-Based Risk Sharing System for Agricultural Lending. NIRSAL reduces the risk for banks that lend to farmers. It provides credit guarantees (up to 75% coverage), which means the bank is more likely to give you the loan because NIRSAL shares the risk. This helps you get affordable loans.

- NLP Tip: To apply for a NIRSAL-backed poultry loan, your first step is usually to prepare your business plan and approach a NIRSAL-partnered bank (like any major commercial bank).

- Ask your commercial bank (e.g., UBA, First Bank) about applying for a NIRSAL-guaranteed loan to improve your approval odds and get a better interest rate.

- Benefits: For example, some NIRSAL-backed poultry packages include training and an insurance bundle to protect your farm.

4. Sterling Bank Agriculture Finance Facilities

Sterling Bank has special loans for farmers. Their “Broiler Finance Facility” is made for poultry farmers. They offer good financing to help you grow your farm and increase your profit. This is often for larger, established farms.

- Contact Sterling Bank’s agriculture desk to get current quotes and terms for their Broiler Finance Facility. Compare rates at local banks to ensure you get the best deal.

Government Loans for Farmers in Nigeria: A Deeper Look

These programs are backed by the Federal Government and are often the best place for new and small farmers to start.

5. FarmerMoni (GEEP 3.0) – Interest-Free Loans for Small-Scale Poultry Farmers

This is a Federal Government program under the Government Enterprise and Empowerment Programme (GEEP). It gives collateral-free, interest-free loans up to ₦100,000. It is made for small-scale (e.g., backyard) farmers. In some areas, it may require you to be part of a registered group or cooperative. It also gives a six-month moratorium period (grace period) before you start paying back. This helps you use the money to make a profit first.

- Visit your Local Government Area (LGA) secretariat to find your GEEP Desk Officer and ask how to register.

6. CBN Anchor Borrowers Programme (ABP) for Poultry

The Central Bank of Nigeria’s (CBN) Anchor Borrowers’ Programme (ABP) helps smallholder farmers. It gives them loans and farm inputs (like day-old chicks and feed).

- How it works: You apply through a Participating Financial Institution (PFI)—which is usually a bank—and are often linked with an ‘anchor’ (a company that will buy your chickens).

- Collateral: Being in a group is key and means minimal collateral is needed.

- Join a registered poultry cooperative or association near you and ask them if they are part of a CBN Anchor Borrowers’ Programme.

7. Commercial Agriculture Credit Scheme (CACS)

This is another CBN program. The CACS gives long-term credit to medium and large-scale farms. The interest rates are low (single-digit). This is for large poultry ventures and is only for limited liability companies (not individuals). You may qualify for up to ₦2 billion with a maximum tenor of 5 years.

- Speak to the commercial banking department at your bank (like First Bank, UBA, etc.) and ask about the CACS.

8. Grant Opportunities: Mastercard Foundation Agribusiness Challenge Fund

This is the Mastercard Foundation Agribusiness Challenge Fund. It’s a grant, which means you don’t pay it back! They give $500,000 to $2.5 million (that’s a lot of Naira!). It’s for registered agribusiness SMEs in Nigeria. Importantly, it requires 30% matching funds from you. It focuses on creating jobs for youth, climate adaptation, and technology. They will have new funding rounds in 2025.

- Check the official Mastercard Foundation website for announcements on the 2025 Agribusiness Challenge Fund application dates.

Poultry Business Loan Requirements in Nigeria (General)

So, what do you need to qualify? Here are the common poultry business loan requirements in Nigeria.

Most programs have general rules. You must be a Nigerian citizen or have a registered Nigerian business. You also need a BVN (Bank Verification Number) and an active bank account.

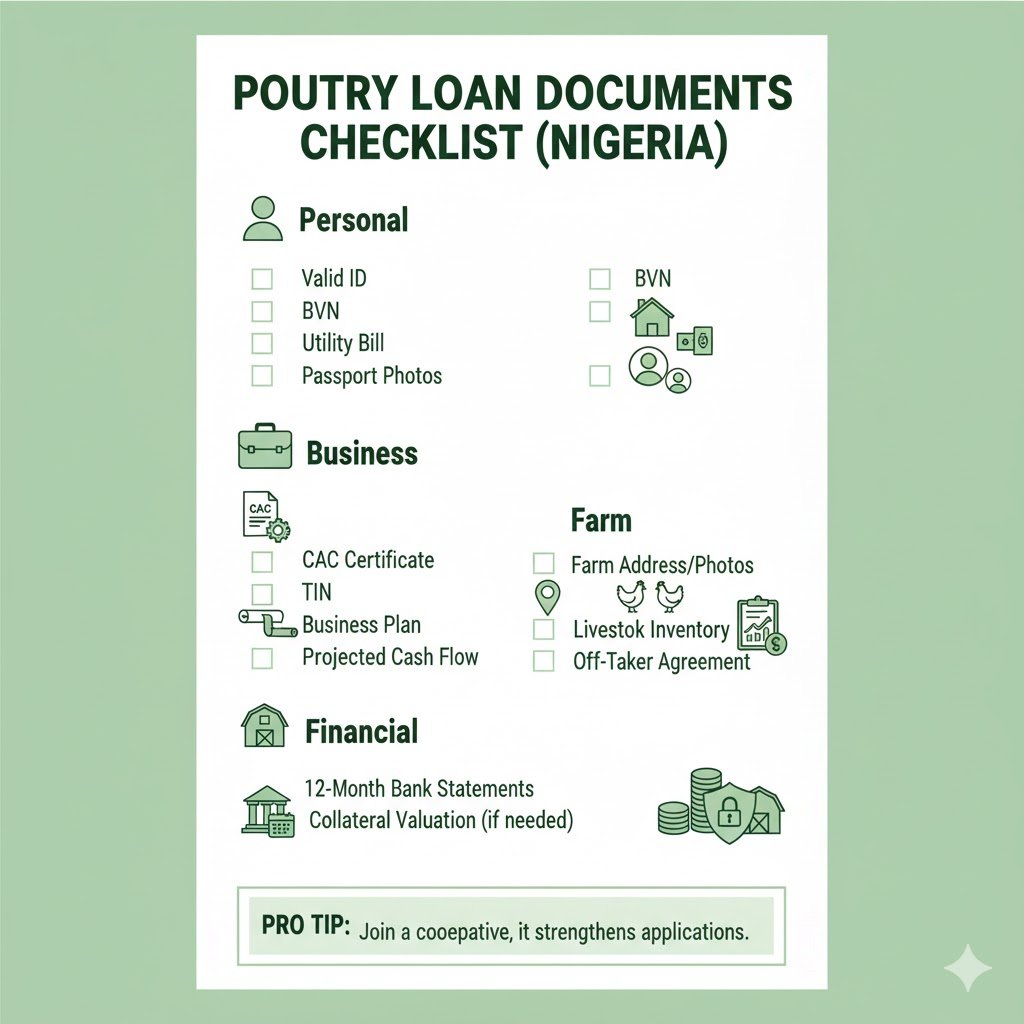

Required Documents for Poultry Loan Applications

Getting your papers in order is key. Trust me, this will save you a lot of time.

Your Application Checklist (Quick View)

Here is a simple checklist. You will likely need:

1. Personal Documents:

- ✓ Valid ID (National ID Card, Driver’s License, or Voter’s Card)

- ✓ BVN (Bank Verification Number)

- ✓ Passport photographs

- ✓ Utility bill (like your NEPA bill, for address verification)

2. Business Documents (for loans over ₦100,000):

- ✓ CAC business registration certificate

- ✓ Tax Identification Number (TIN)

- ✓ A detailed Business Plan (Use our downloadable poultry business plan template [.docx])

- ✓ A Projected Cash Flow analysis

3. Farm-Specific Documents:

- ✓ Details of your farm’s location (address, photos, or GPS)

- ✓ List of your current livestock (if you are expanding)

- ✓ Off-taker agreements (letters from hotels, restaurants, or markets that agree to buy your chickens)

4. Financial Documents:

- ✓ 12-month bank statements

- ✓ Collateral valuation report (if needed)

For some programs, age matters. For example, some GEEP loans target youth aged 18-45. For large loans like LPRES, your business must be well-structured with a clear team.

Maximizing Your Loan Approval Chances

How can you make sure the bank says YES? Here are some tips from farmers who got their loans.

- Join a Cooperative: This is the best tip. Banks trust cooperatives. Being in a member of a farmers’ association or cooperative society makes your application much stronger.

- Keep Clean Bank Records: Make sure you are not always in debt. Show that you can manage money.

- Start Small: If you are new, apply for a small loan first. Pay it back on time. This builds your credit history and trust with the bank.

- Show Your Market: Prove that you have buyers for your eggs and meat. Get a letter from a local restaurant, hotel, or market woman (especially in urban areas like Lagos or Abuja) who agrees to buy from you.

- Get Trained: Show you have farming knowledge. Go to a training program (like from Songhai) and get a certificate.

- Be Realistic: Don’t ask for ₦5 million when your business plan only shows a ₦1 million idea. Your financial projections must be realistic.

- Work with GEEP Officers: For FarmerMoni, work closely with your local GEEP Desk Officer. They are there to help you.

Common Mistakes That Lead to Rejection (Expanded)

Avoid these mistakes:

- Unrealistic Business Plan:

- Example: Asking for ₦5 million but your plan only shows a market for 100 birds. The numbers don’t match, and the bank will see it.

- Incomplete Documents:

- Example: Forgetting to include your BVN or providing a bank statement that is 3 months old instead of the 12-month history they asked for.

- Poor Credit History:

- Example: Having an old, unpaid ₦20,000 loan from another app. Banks check your credit report. This will show up and get you rejected.

- No Experience (for large loans):

- Example: Applying for a ₦10 million BOA loan for 1,000 birds having never raised a chicken. Banks see this as high risk.

- No Clear Market:

- Example: Stating you will “sell to people in Lagos.” This is too vague. A good plan says, “I have an off-taker agreement with 3 local restaurants in Ikeja to supply 100 broilers weekly.”

- Insufficient Equity:

- Example: For the DBN-LPRES loan, you need 30% equity. If your project is ₦10 million, you must prove you have ₦3 million in cash or assets.

What if I’m a Beginner with No Experience?

This is a very common question. It is hard to get a big loan with no experience. Banks see you as high-risk. This is a good time to consider a “poultry side hustle” in Nigeria. Here is your strategy:

- Get Training First: Your best option is to join a program that gives training and startup capital. Look for:

- Songhai/Mastercard Foundation: Gives 3 months of training plus seed capital.

- NYESAF (Nigerian Youth Empowerment through Skills Acquisition Fund): They sometimes run poultry training programs and give graduates a starter-pack.

- Start Small: Do not apply for a ₦1 million loan. Start with a 50-bird farm in your backyard.

- Use your personal savings or an interest-free FarmerMoni loan (₦50,000 – ₦100,000).

- This lets you learn how to manage day-old chicks, feed, and vaccinations without a big risk.

- You will build a track record. After 1-2 successful cycles, you can go to the Bank of Agriculture with your records and ask for a bigger loan to expand.

- Join a Cooperative: As a beginner, your best friends are other farmers. Join a local cooperative. You get training, support, and access to group loans.

Calculate Your Potential Poultry ROI (Return on Investment)

To get a loan, you must show the bank you can make a profit. This simple ROI calculation helps.

- Total Cost (A): (Cost of Chicks + Cost of Feed + Cost of Meds/Vaccines + Other costs)

- Example: ₦30,000 (50 chicks) + ₦45,000 (Feed) + ₦5,000 (Meds) = ₦80,000

- Total Revenue (B): (Number of Birds Sold x Sale Price)

- Example: 48 birds (assuming 2 died) x ₦3,500 per bird = ₦168,000

- Profit (C): (Total Revenue (B) – Total Cost (A))

- Example: ₦168,000 – ₦80,000 = ₦88,000

- ROI (D): (Profit (C) / Total Cost (A)) x 100

- Example: (₦88,000 / ₦80,000) x 100 = 110% ROI

Disclaimer: This is a simple example for broilers. Your real costs for feed (check how many bags of feed for broilers?) and revenue will be different. Show this calculation in your business plan.

Risks to Consider Before Taking a Loan

Loans are a powerful tool, but they are also a big risk. You must be careful.

- Risk 1: Default and Blacklisting: If you fail to pay back your loan, the bank will report you to the Credit Bureaus. Your name will be on a “blacklist.” This will destroy your credit score and make it almost impossible to get another loan in Nigeria for many years.

- Risk 2: Legal Action: The bank can take you to court to recover its money. A collection agency might be sent to contact you, which can be very stressful.

- Risk 3: High-Interest Rates: Government loans (like BOA or FarmerMoni) have low or 0% interest. But private loans or microfinance banks can have very high rates. If your chickens get sick or the price of feed goes up, a high-interest loan can eat all your profit.

- Risk 4: Losing Collateral: If you use your land or house as collateral for a big loan and you fail to pay, the bank has the legal right to seize and sell your property.

- Risk 5: Over-borrowing: Don’t take a ₦2 million loan when you only need ₦1 million. You will be paying interest on money you don’t need. Only borrow exactly what your business plan says you require.

- Risk 6: Lack of Insurance: If your farm is hit by disease (like bird flu) or fire and you have no insurance, you will still owe the full loan amount, even with no birds left to sell. Most banks or NIRSAL-backed loans may require NAIC cover. Learn more at https://www.naic.gov.ng.

Understanding Loan Terms: Interest Rates, Repayment, and Tenure

Let’s break down the financial terms in simple English.

- Interest Rate: This is the cost of borrowing money.

- FarmerMoni: 0% interest-free. You only pay back exactly what you borrowed.

- Bank of Agriculture: Varies, from 9% up to 14%. (Rates as of Nov 2025; always confirm the current rate).

- CACS: Single-digit rates.

- Repayment Schedule: This is the plan for how you will pay the money back (e.g., monthly).

- Some loans, like FarmerMoni, have a moratorium period. This is a 6-month holiday before your repayments start. This is amazing for farmers.

- Repayment can be from 1 to 5 years, depending on the loan.

- Loan Tenure: This is the total time you have to pay back the loan.

- Working capital (for things like feed and day-old chicks) usually has a 12-month tenure.

- Asset/Expansion finance (for building a poultry house) can have a tenure of up to 6 years.

Alternative Financing Options for Poultry Farmers

What if you don’t get a loan? Or what if you don’t want one? Here are other ways to get money.

- Grants: These are gifts! You don’t pay them back.

- Mastercard Foundation Agribusiness Challenge Fund: Offers $500,000 – $2.5 million for growing agribusinesses, but you need 30% matching funds.

- Songhai/Mastercard Foundation: Gives 3 months of training and seed capital to youth.

- Nigeria Youth Futures Fund (NYFF): Supports youth-led agricultural businesses.

- Personal Savings: This is the best, (if you can). It’s called bootstrapping.

- Crowdfunding: Using websites to ask many people for small amounts of money.

- Supplier Credit: Getting your feed supplier to give you feed on credit, and you pay after you sell your birds.

- Cooperative Financing: Your local co-op may give out its own small loans to members.

Success Stories: Nigerian Poultry Farmers Who Secured Loans

Don’t just take my word for it. Real people are using these loans.

- Case Study: Hauwa Musa, Lagos Hauwa Musa thanked the government for her FarmerMoni loan. She said the support “significantly impacted her life and helped expand her business.” She likely started with a ₦75,000 interest-free loan. After the six-month moratorium, she used her egg sales to start repayments. She now runs a 150-layer operation.

- Case Study: Emeka, Kano From my visits to farms in Kano, Emeka’s story (one of the farmers I spoke to) is common. He runs a medium-sized broiler farm and needed ₦1.5 million to buy a new feather-plucking machine and build a bigger pen. He joined a local poultry cooperative and applied for a Bank of Agriculture loan. He said the 9% interest rate was “a blessing.” It took 6 weeks for approval, but he got the loan and has now doubled his production. His advice? “Join a cooperative. Do not go alone.”

Timeline: When to Apply and What to Expect

Patience is important. Here is a typical timeline:

- Application to Approval: 2 to 8 weeks.

- Document Verification: 1 to 2 weeks.

- Credit Assessment: 1 to 3 weeks.

- Disbursement (getting the money): 1 to 4 weeks after approval.

When is the best time to apply? Now.

- FarmerMoni disbursements are starting before the end of 2025.

- The GEEP 3.0 phase is expected to start soon.

- Mastercard Foundation grant cycles are open during 2025.

Apply as early as you can, because many programs have limited slots.

Frequently Asked Questions (FAQ) on How to Get a Loan for Poultry Farming in Nigeria

Here are quick answers to common questions.

Q: What is the maximum loan amount for poultry farming in Nigeria?

A: It varies a lot. You may qualify for ₦100,000 from FarmerMoni (interest-free), up to ₦1.8 billion from Fidelity DBN-LPRES, or from ₦250,000 up to ₦5 million (for individuals) from the Bank of Agriculture.

Q: Do I need collateral for poultry farming loans?

A: Not always. FarmerMoni is collateral-free. The Bank of Agriculture often does not ask for collateral for its small loans. NIRSAL also provides credit guarantees to reduce collateral needs.

Q: How long does it take to get approved?

A: Usually 2 to 8 weeks. It depends on the program and if your documents are complete. FarmerMoni payments are starting before the end of 2025.

Q: Can I get an interest-free loan for poultry farming?

A: Yes! The Federal Government’s FarmerMoni (under GEEP) gives interest-free, collateral-free loans up to ₦100,000 to small-scale poultry farmers.

Q: What is the interest rate for Bank of Agriculture poultry loans?

A: The interest rate varies. It can be 9% for some loan types, but up to 14% for others. You must check with BOA for the exact rate for your loan.

Q: Do I need farming experience to qualify?

A: It helps a lot. If you have no experience, your best bet is to either get training first (like from a Songhai or NYESAF program) or start very small with your own money or a FarmerMoni loan.

Q: Can cooperatives apply for loans?

A: Yes! The Bank of Agriculture loves working with cooperatives. Being in a recognized association makes it much easier to get approved.

Q: When should I apply for 2025 loans?

A: Apply now. FarmerMoni disbursements are happening before the end of 2025, and GEEP 3.0 is starting soon. Mastercard Foundation grant cycles are open throughout 2025.

Q: What if my loan application is rejected?

A: Don’t give up. First, ask the bank (politely) why you were rejected. It was likely one of the “Common Mistakes” listed above. If it was incomplete documents, fix them. If it was a poor business plan, revise it. If it was a bad credit score, take 6 months to clear your debts. You can also re-apply for a smaller loan or to a different program.

Q: How do I find off-takers in Lagos or Abuja?

A: Start local. Go to hotels, restaurants, and “frozen food” shops in your area with samples. Ask to speak to the manager or procurement officer. Offer a reliable supply and a fair price. Join a cooperative; they often have existing off-taker agreements.

Further reading (Nigeria)

- Poultry farming business plan (Nigeria)

- Cost of starting a 200-layer farm in Nigeria

- Broilers vs. layers profit in Nigeria

- Poultry equipment price list in Nigeria

- Where to buy high-quality day-old chicks in Nigeria

- How to manage poultry in harmattan

Conclusion and Next Steps

Getting a loan for your poultry farm in Nigeria is possible. You just need to know where to look and how to prepare.

With the Federal Government planning to expand GEEP’s reach (with a broader rollout in 2026), now is the best time to learn how to get a loan for poultry farming in Nigeria.

Here are your next steps:

- Assess Your Needs: Calculate exactly how much money you need.

- Choose a Program: Pick the loan that fits your farm size (FarmerMoni for small, BOA for medium, LPRES for large).

- Gather Your Documents: Start getting your BVN, ID, and business plan ready today.

- Join a Cooperative: Find your local poultry farmers’ association and join.

- Apply: Contact the GEEP officer for FarmerMoni, or visit a Bank of Agriculture branch for BOA loans.

Good luck. You can do this.

Did you find this guide helpful? Please share it with other aspiring farmers on WhatsApp or Facebook. Do you have your own experience with getting a loan? Or do you have a question I didn’t answer? Leave a comment below! Your opinion and stories can help other farmers.

Oladepo Babatunde is the founder of ChickenStarter.com. He is a backyard chicken keeper and educator who specializes in helping beginners raise healthy flocks, particularly in warm climates. His expertise comes from years of hands-on experience building coops, treating common chicken ailments, and solving flock management issues. His own happy hens are a testament to his methods, laying 25-30 eggs weekly.